sacramento county tax rate

The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US.

Sacramento County Ca The Bishop Real Estate Group

Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the.

. The Sacramento County sales tax rate is. The 2018 United States Supreme Court decision. In addition the rate includes an amount equal to the amount needed to make payments.

T he tax rate is 55 for each 500 or fractional part thereof of the value of real property less any loans assumed by the buyer. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Sacramento Countys Online Property Tax Bill Information System.

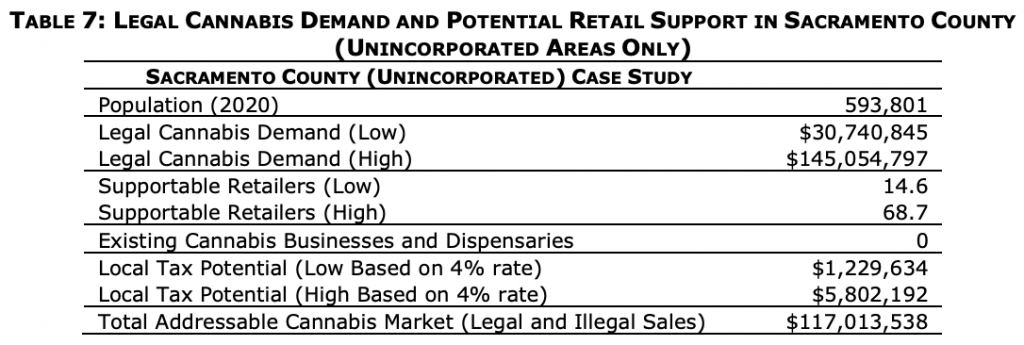

This is the total of state and county sales tax rates. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

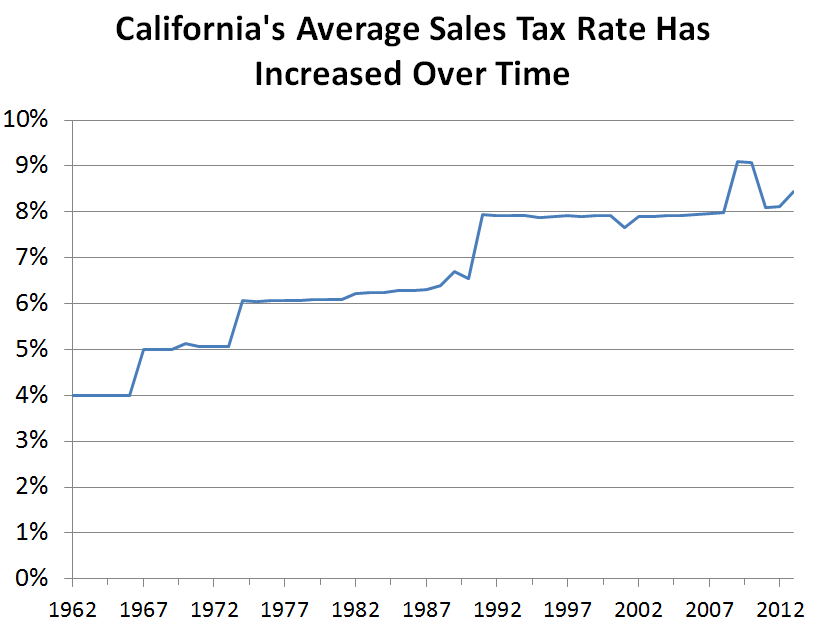

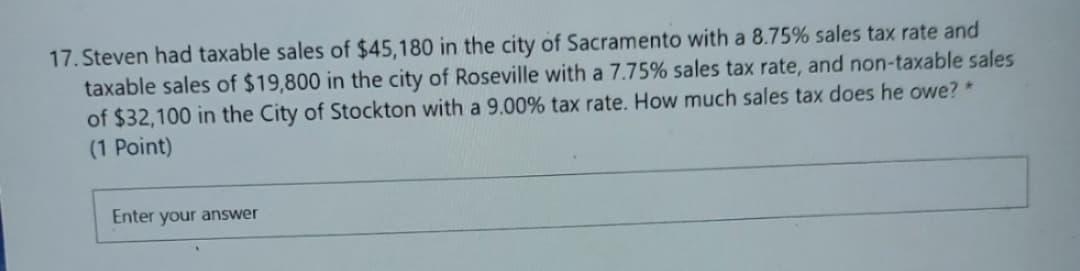

Privately and commercially-owned boats and aircraft are also subject to personal property taxes. 33 rows The local sales tax rate in Sacramento County is 025 and the maximum rate including. 5 rows The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025.

2021-2022 compilation of tax rates by code area code area 03-035 code area 03-036 code area 03-037 county wide 1 10000 county wide 1 10000 county wide 1. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. Tax Rate Areas Sacramento County 2022.

6 rows The Sacramento County California sales tax is 775 consisting of 600 California state sales. Compilation of Tax Rates by Code Area. View the Boats and Aircraft web pages for more information.

The minimum combined 2022 sales tax rate for Sacramento California is. View the E-Prop-Tax page for more information. Secured - Unitary Tax Rolls Collections.

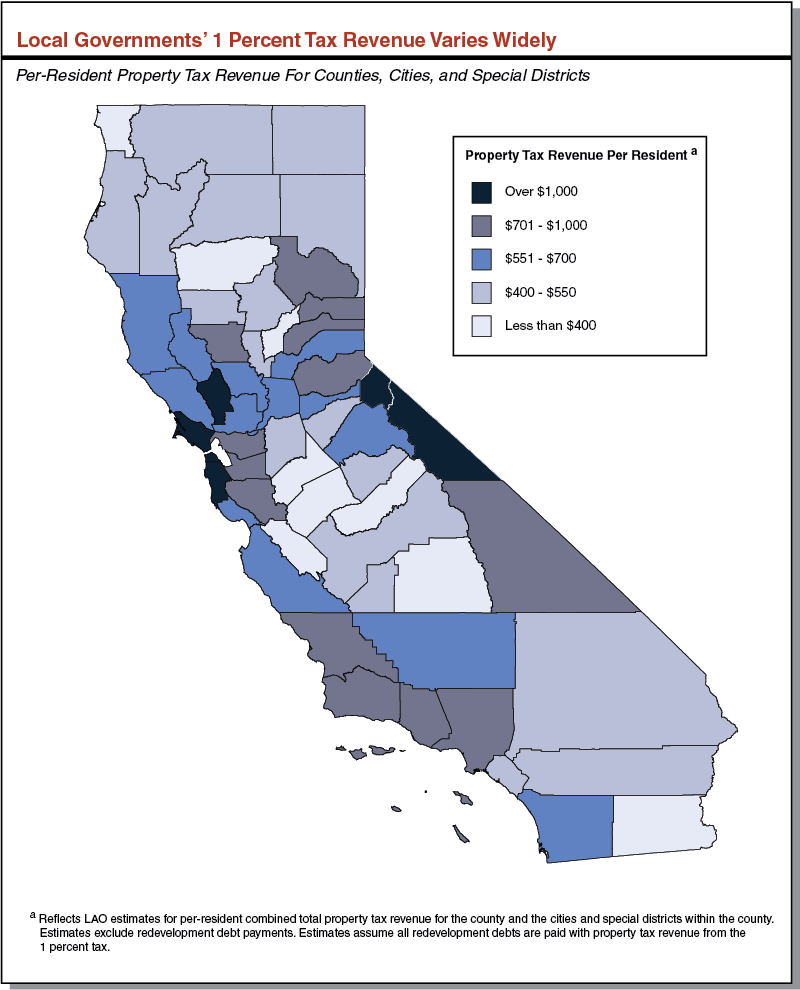

The County levies an ad valorem property tax at a rate equal to one percent 1 of the full cash value. The California state sales tax rate is currently. This is the total of state county and city sales tax rates.

What is the sales tax rate in Sacramento California. Automated Secured Property Information Telephone Line. Available 24 Hours a day 7 days a.

Differences In Property Tax Revenue For Counties Cities Special Districts Econtax Blog

The Property Tax Inheritance Exclusion

California S Sales Tax Rate Has Grown Over Time Econtax Blog

2020 21 Sacramento County Property Assessment Roll Tops 189 Billion

2020 21 Sacramento County Property Assessment Roll Tops 189 Billion

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

California Taxpayers Association California Tax Facts

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Sacramento Sales Tax Ballot Measure Funds Roads Bridges The Sacramento Bee

What You Need To Know About California Sales Tax Smartasset

Solved 17 Steven Had Taxable Sales Of 45 180 In The City Chegg Com

New Sales And Use Tax Rates In Newark East Bay Effective April 1 Newark Ca Patch

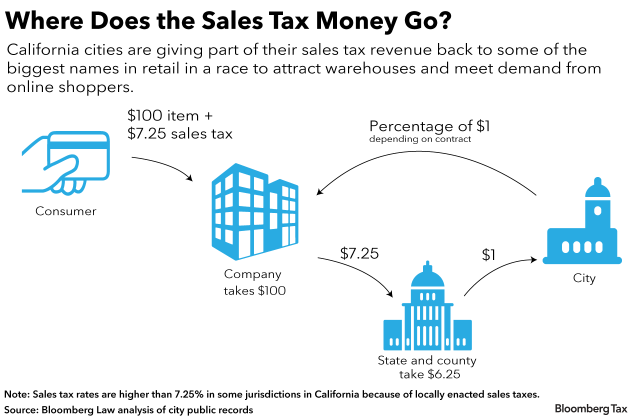

Apple S 22 Year Tax Break Part Of Billions In California Bounty 1

Sacramento County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

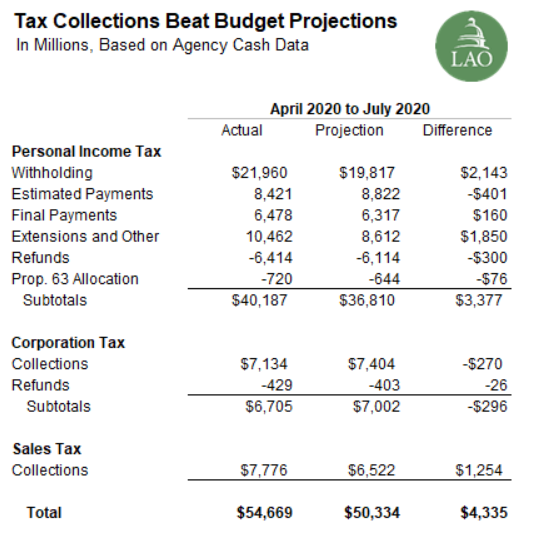

State Tax Collections Update April 2020 To July 2020 Econtax Blog